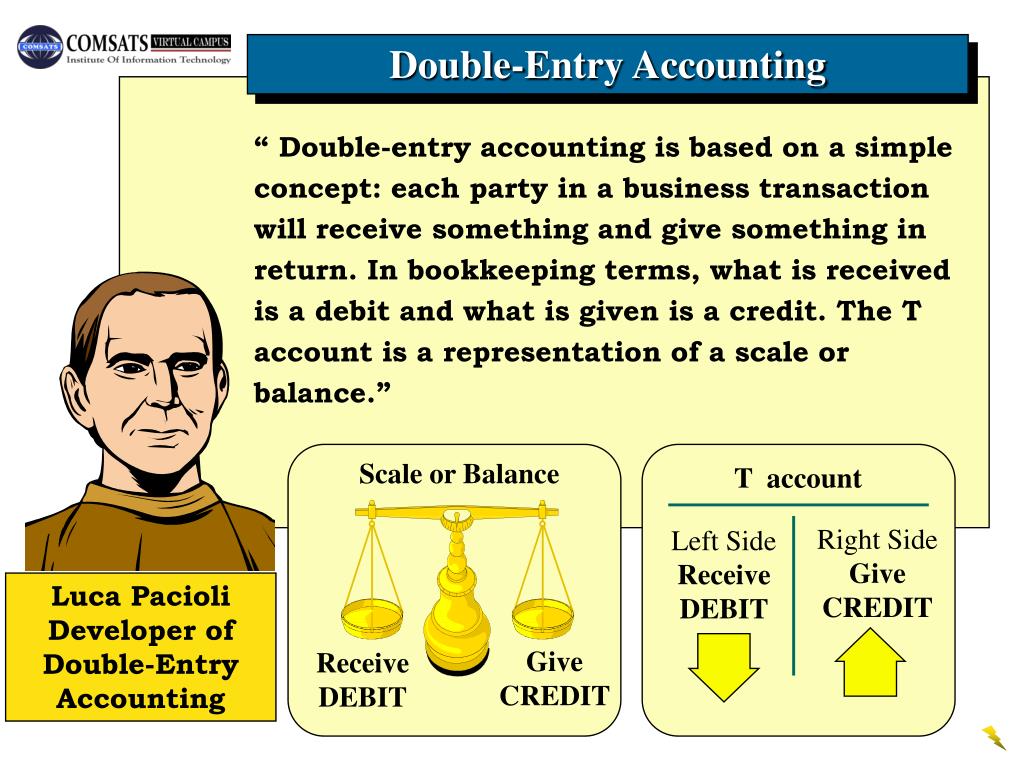

Recordkeeping is handled as single entry accounting and double entry accounting. Contrary to single-entry accounting, which tracks only revenue and expenses, double-entry accounting tracks assets, liabilities and equity, too. Your books are balanced when the sum of each debit and its corresponding credit equals zero. Journalizingĭouble-entry accounting is a system that requires two book entries - one debit and one credit - for every transaction within a business. When you’re working with a company’s general ledger, it’s important to keep the equation in balance. Unlike double entry accounting, a single entry accounting system - as suggested by the name - records all transactions in a single ledger. The general journal is where double entry bookkeeping entries are recorded by debiting one or more accounts and crediting another one or more accounts with the same total amount. This transaction is recorded by debiting the vehicles account for $20,000, crediting the notes payable account for $18,000, and crediting the cash account for $2,000. Suppose the company’s owner purchases a used delivery truck for $20,000 on August 6 by making a $2,000 cash down payment and obtaining a three‐year note payable for the remaining $18,000. These tools detect and transcribe the accounting entries directly into the appropriate debit and credit accounts.Ī compound entry is necessary when a single transaction affects three or more accounts.The best way to get started with double-entry accounting is by using accounting software.The former deals with making a one-time entry into an account, be it an expense or income.Accounting SystemAccounting systems are used by organizations to record financial information such as income, expenses, and other accounting activities.

#Brief history of double entry bookkeeping trial

Deciding if double-entry accounting is right for you.

0 kommentar(er)

0 kommentar(er)